Advisory services

Governance of Risk

KEY OUTCOMES

Identify critical board performance factors and implement an ascent plan toward success

About Governance of Risk

The discipline of risk management has been moving away from just focusing on threats to an organisation to encompass threats and opportunities that may affect the organisations objectives. The last three Royal Commissions and a slew of corporate failures consistently highlight that an organisations ‘risk culture’ rather than their risk framework, is more of an indicator of how organisations manage their threats and opportunities.

Governance of risk requires directors to protect the interests of an organisation, its clients, employees, and the communities in which it operates. At the same time, directors need to identify and leverage the key opportunities that present themselves.

Governance of Risk Overview

Good governance of risk enables directors to work with management to ensure that risk management is an enabler of an organisation’s performance and growth and in our current uncertain times. It ensures that fit-for-purpose risk systems, processes and culture identify and maximise opportunities whilst minimising threats to its stakeholders and organisational objectives. Additionally, when those threats occur, is the organisation geared to fail gracefully and recover quickly no matter what the incident is?

With growing expectations on directors around compliance, good risk governance can empower directors to demonstrate how the organisations risk appetite is defined, how it supports the organisations objectives and is effectively implemented by management.

Governance of Risk Services Components

Workshopping strategic risk threat and opportunity identification

Risk culture analysis and change

Fit-for-purpose Risk Management Frameworks

Fit-for-purpose Risk Appetite statements

Why Governance of Risk Services?

Governance of risk services address a range of governance and strategic challenges such as:

- Management and external stakeholders do not clearly understand the risk appetite of the board

- Excessive risk governance is limiting opportunities for organic and inorganic growth and the organisations performance

- Prioritising and funding risk controls may not be appropriate causing unwanted outcomes for stakeholders

- Directors may not understand what they do not know regarding key operational risks such as ESG, Cyber, People, Technology, Climate change, Political and Foreign risk.

- Despite current risk management practices organisations still don’t seem to respond well to significant risk incidents.

Our Approach

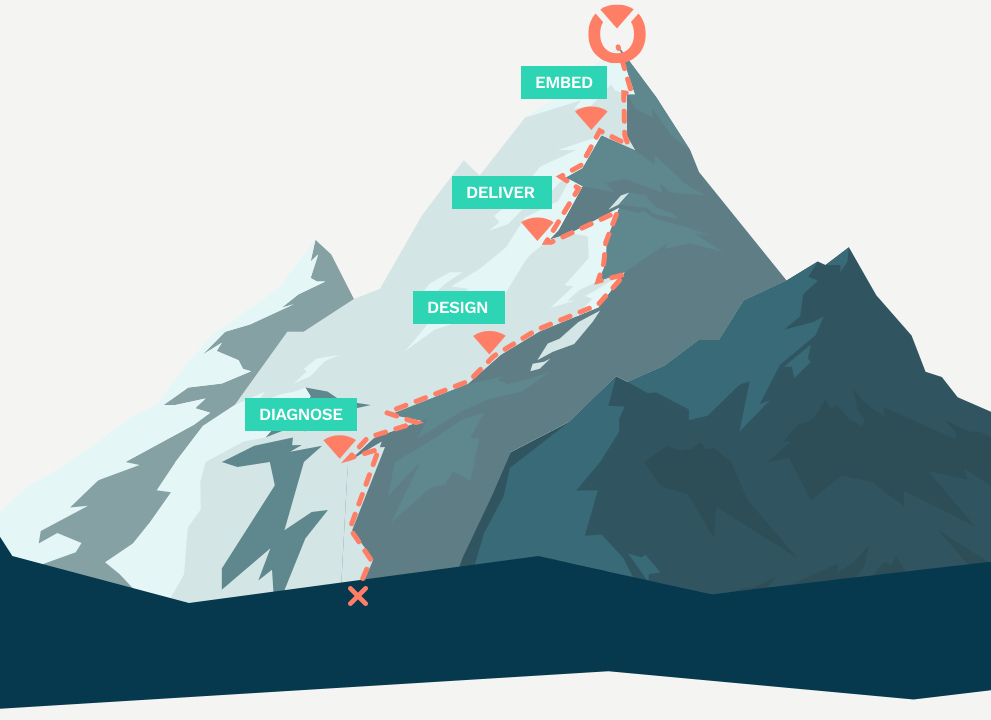

The Peakstone Global approach to Advisory Services covers the full project lifecycle of diagnose, design, deliver and embed

Our specific approach elements to delivering Governance of Risk advisory services are:

- Reviewing internal frameworks and standards and how well they are translated to practices by management

- Undertaking a maturity assessment and developing a roadmap to bridge the gap between current state and desired future state for the three key components of Technology Governance:

- Cyber security

- Information

- Technology

- Benchmarking to global frameworks and standards

- Workshopping / facilitation of board risk appetite and alignment with management’s ability to create the right risk culture

- Aligning of risk appetite with strategic plan and changes in the external operating environment

- Stretching the board and management to delineate between continuous improvement and innovation

- Facilitating the board setting the most appropriate cultural and ethical ‘tone from the top’